Taxation software for institutions

Taxation software for institutions

The FE software is aimed at Local Taxation Agencies (Companies that work as licensees on behalf of Councils and territorial Authorities such as Associations, the Local Health Service, etc,) and the Tax Authorities.

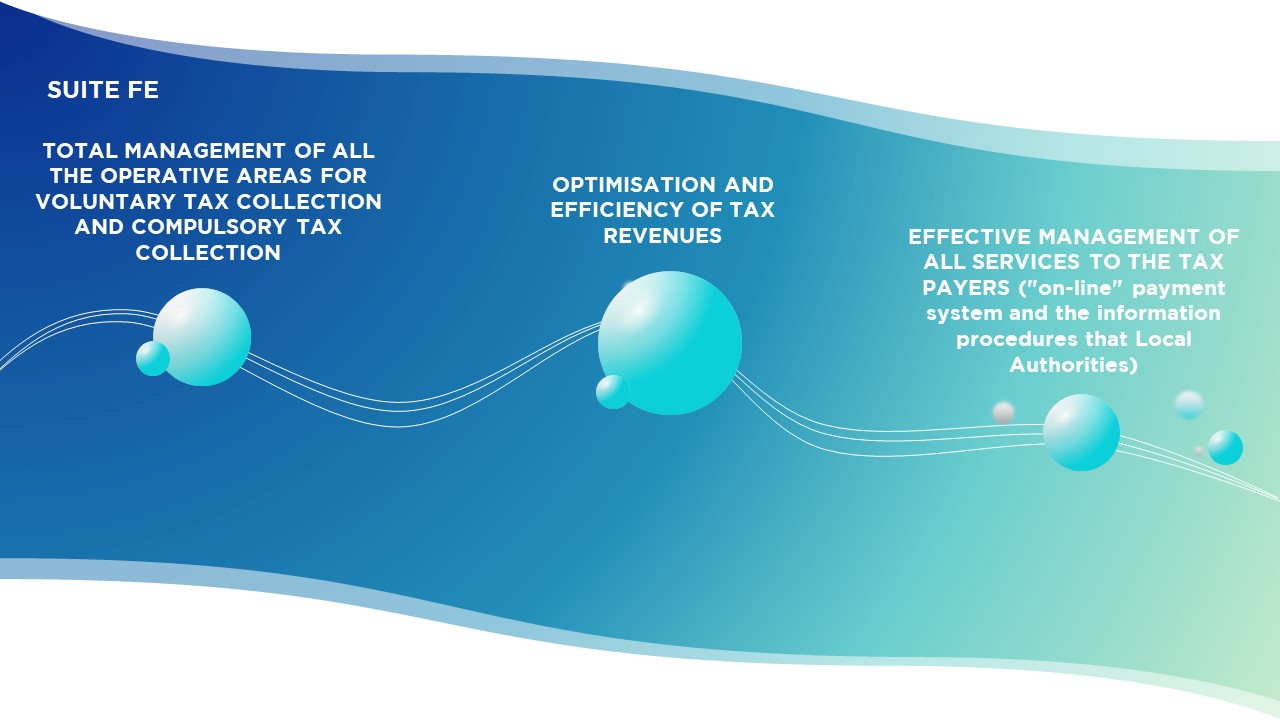

FE optimises and efficiently manages Tax Revenues, Voluntary and Compulsory Tax Collection as well as all the activities foreseen by the laws in force integrated with the various e-Government projects.

Furthermore, FE provides the total management of all the operative areas for voluntary tax collection (payment notification) and compulsory tax collection, by issuing "Tax Injunction Orders," which have replaced the previous tax collection system.

FE is made up of a series of distinct and independent, yet entirely integrable, "Operative Modules" which can be configured according to each customer's particular needs (Treasury Credit Institutions, Local Authorities, Public Body Associations, Tax Collection Agencies, subjects and Licensed Companies enrolled on the register in accordance with art. 53, paragraph 1 of Leg. Dec. 446/1997).

The functionalities of FE have been developed to effectively manage services to the Tax Payers (citizens and businesses) both in terms of the "on-line" payment system and the information procedures that Local Authorities are expected to provide (account balances, tax positions, requests for payment instalment measures, etc.).

CAD IT offers this solution under licence or through outsourcing so that the customer can activate the service almost immediately.

italiano

italiano english

english español

español