Cash & Liquidity Management

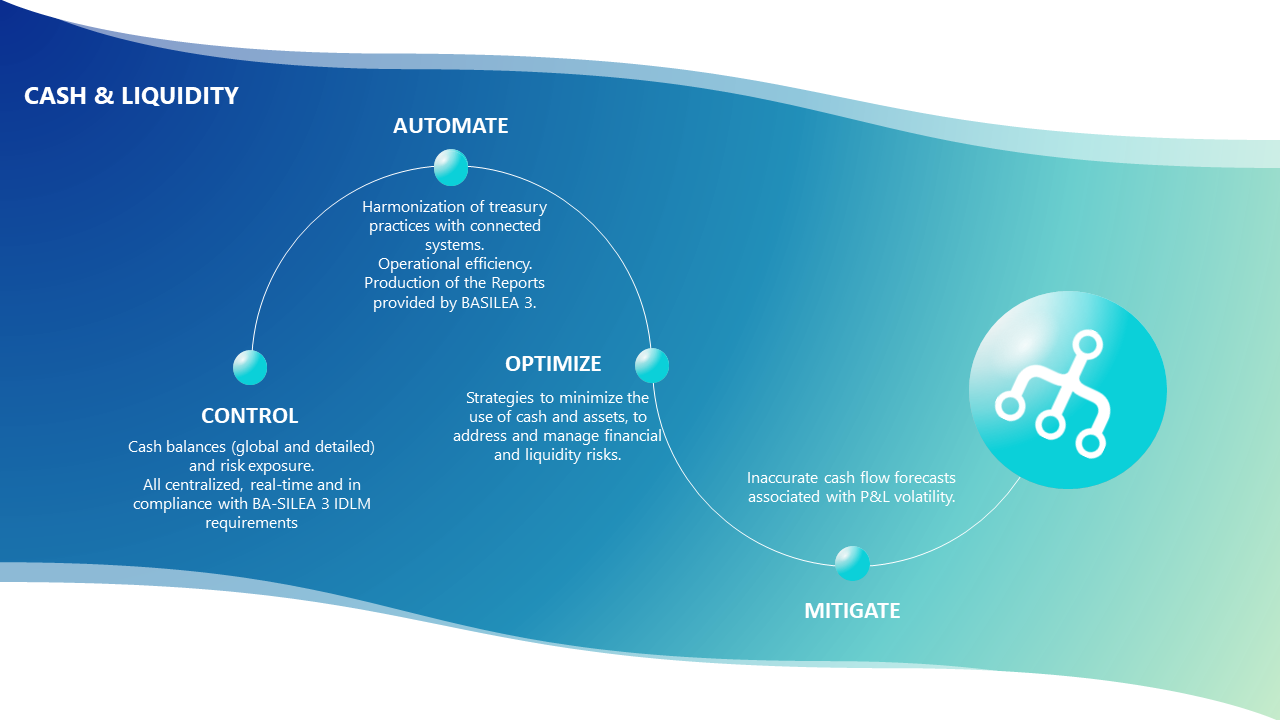

CAD IT's Cash & Liquidity Management, supports the Treasury in managing the Liquidity needed for all the Bank's or Financial Institute's activities.

Cash & Liquidity Management

Constant evolution in the Payment System world, globalisation and high market volatility make Treasury activities more and more complex and Treasury is forced to face difficult challenges on a daily basis: risk management, uncertainties concerning the quality of information gathered, processing of reliable forecasts and satisfying the current regulatory requirements set by institutional entities (like, for example, the Basel Committee of Banking Supervision, BCBS).

Underestimating these scenarios can lead to high risk in terms of wasting resources in activities with poor added value, running into pointless expenses linked to interest rates and not achieving cash flow objectives. It is therefore necessary to find a solution that would offer the greatest number of benefits and advantages to the user. A solution that would be able to respond, at any moment, to the most important questions in terms of liquidity management:

- What is the current Cash availability? Where is it? Which date does it refer to?

- How much Cash availability do I need? Where and on which accounts? When will I need it?

CAD IT aims at determining factors to achieve this objective, in other words: detailed collection and management (also in real-time if possible) of all the necessary information, check functions that guarantee the quality of the data used, product adaptation to all possible operative configurations, maximum usability in order to reduce errors and increase user action effectiveness.

SPIKE, CAD IT's Cash & Liquidity Management, supports the Treasury in managing the Liquidity needed for all the Bank's or Financial Institute's activities. Adaptable to the organisational structure in terms of security/enablement and operative workflow, SPIKE interfaces with the Systems (Internal and External) that operate on liquidity, providing an overall and detailed view of the Cash trend: End of Day, Intraday and Forecast, all supported by graphics and parameterisable alert functions. There is a Funding functionality which also acts automatically, processing transaction "proposals" (giros and transfers) on the basis of rules linked, for example, to balance and average stock. The user can modify and/or confirm these proposals which, if sent to the Systems of reference, will immediately be used by the application to calculate forecasts.

Report management is an important advantage that SPIKE offers to the Liquidity Manager in order to meet accounting needs at all organisational levels as well as everything foreseen by the regulations (e.g. Central Banks, BASILEA 3, etc.). Print-outs can be produced automatically or on command by the user who, starting from all the information in the database, can manage reporting through pre-defined models or in a personalised manner. The reports can be edited on the basis of all the most commonly used layouts (pdf, csv, xls, txt, etc.).

italiano

italiano english

english español

español