Area Finanza for Asset Management

Area Finanza for Asset Management

Over the last years the Asset Management industry has grown very quickly. The economic crisis, the lowering of interest rates, the opening of new markets led customers to invest in a diversified manner. A large amount of savings has been invested in Asset Management products (Mutual Funds, ETF, SICAV, Pension Funds, Hedge Funds, Insurances, etc.) that allow to invest in a diversified manner even small amounts.

Asset Management industry has also been affected by considerable changes:

- growing diversification of financial instruments which has gradually made their administration more complex;

- markets and settlement evolution which aims at greater efficiency and standardization;

- rearrangement of legal and institutional regulation, which aim at safeguarding customers and rationalizing processes in increasingly turbulent and uncertain competitive contexts;

- intense technological innovation together with progressive market integration;

- fiscal context where each country follows its own policies.

The overall effect has been a notable change in the characteristics of Asset Management and the operative ways of the financial institutions, emphasizing the need to:

- coordinate different processes and data flows;

- consider the logics which guide the investment and financial strategies as a whole and to give to the asset manager a directorship role in the decisions.

The competition and the urgency dictated to business have led many financial institutions to combine, in an often not well structured pattern, mixed solutions made up of purchased and inhouse softwares, sacrifying quality and efficiency to have quantitative results and inappropriate performances.

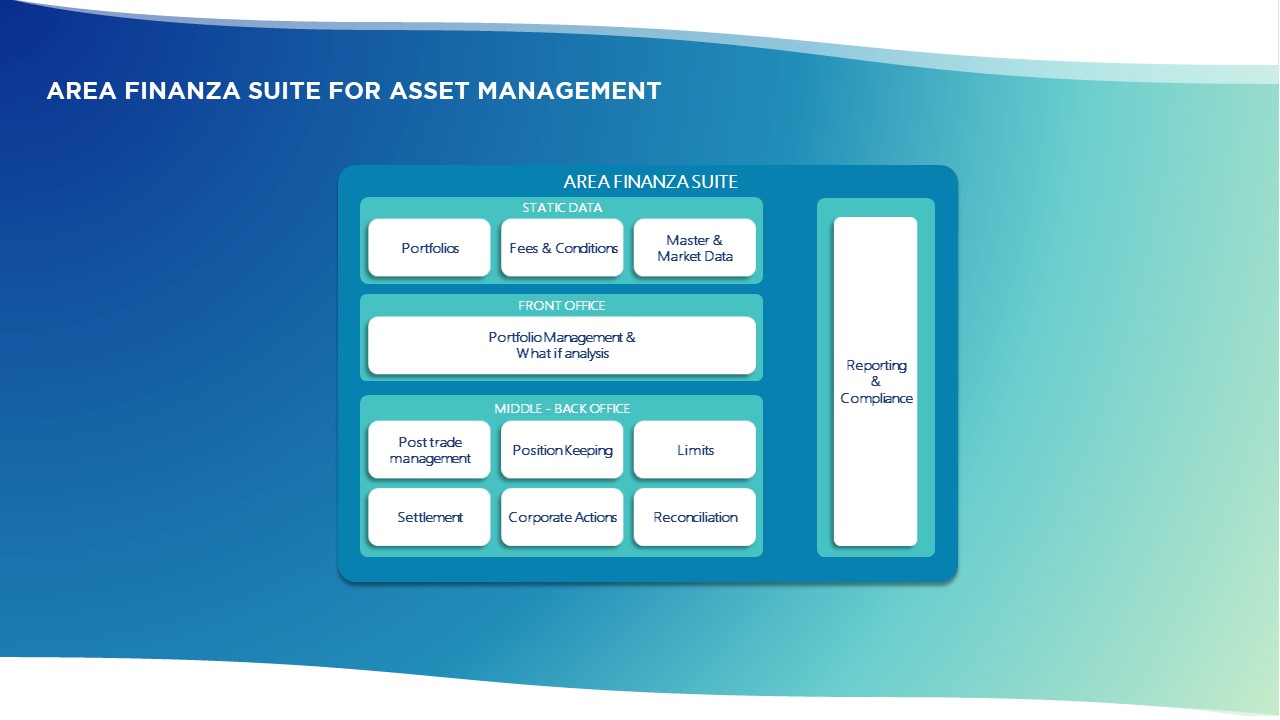

Area Finanza Suite for Asset Management: the CAD IT's solution

With over 200,000 users from high standing financial institutions, CAD IT's Area Finanza is the securities trading and post-trading process management system most widely used in Europe.

Supported by considerable investment in Research and Development and a team of 600 highly qualified experts, Area Finanza Suite for Asset Management ensures regulation compliance, adaptability to market evolution and technological innovation.

Salient features

Area Finanza Suite for Asset Management is a Front to Back solution that offers total automation of all processes relating to securities in the following macro areas: Investments policy, Strategic Asset Allocation, Order Management, Trading Rooms, Risk Management, Position Keeping, Administration, Corporate Actions, Master Data Management, Settlement, Reconciliations, Fund Administration (Fund Accounting and NAV calculation), Compliance and Reporting.

Area Finanza Suite for Asset Management is a cross asset classes solution (Fixed income, Equities, Derivatives, Structured bonds, Certificates, Rights, Warrants, Covered Warrants, ETF, Funds & SICAV, Commodities, FX) that enables the management of high volumes in real time, supporting multi-language, multi-currency, multi-channel and multi-institute configurations for banking groups, insurance companies, funds and trust companies and business process outsourcers.

Area Finanza Suite for Asset Management has been conceived on the basis of an architecture platform independent, service-oriented, with granular standard-components organically connected, to adapt flexibly to the specific needs of each customer.

italiano

italiano english

english español

español